is interest on your car loan tax deductible

In order to do this your vehicle needs to fit into one of these IRS categories. In most cases your car loan interest is not tax deductible.

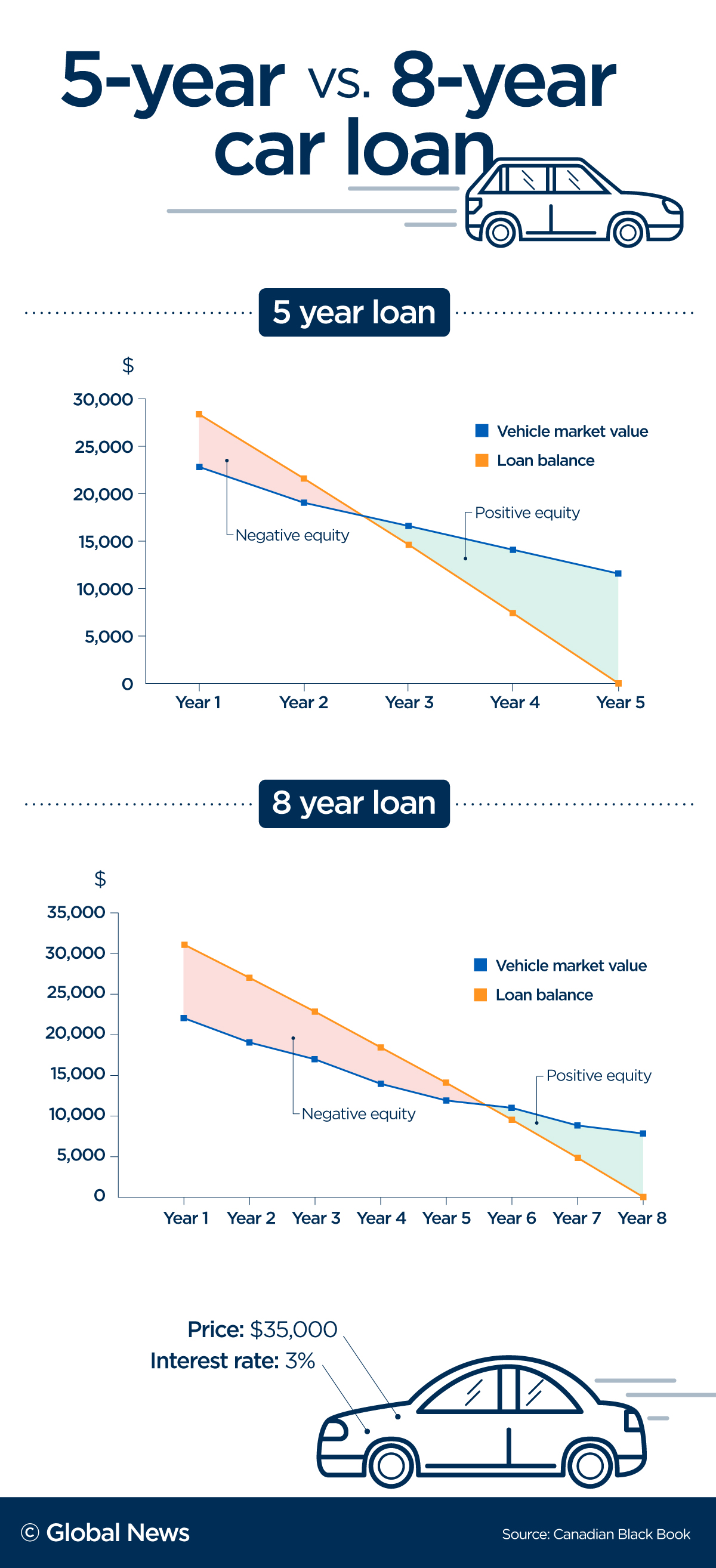

Your Car Loan Payment May Be Way Too High Here S What S Happening National Globalnews Ca

The taxpayer borrows 50000 secured by his home to be used in his consulting business.

. Commercial Car Loan Is Tax-Deductible When you take out car finance to purchase a vehicle for use in your business the interest you pay on the loan is a business expense. For regular taxpayers deducting car loan interest is not allowed. Only those who are self-employed or own their own business and use a vehicle for business purposes may claim a tax deduction for car loan interest.

This means that you can claim a tax deduction based on the proportion that business use makes up the total use of the vehicle. The interest on a car title loan is not generally tax deductible. When car loan interest is deductible 1.

So if you drive your car 50000 miles and 25000 of these miles are for business you can deduct 50 of your car-related expenses including 50 of the interest you pay on your car loan. The Tax Cuts and Jobs Act of 2017 changed the rules for the mortgage interest deduction. The state level is a bit.

1 Credit Report Get your credit score now. The taxpayer must allocate interest expense on the loan between rental interest and personal interest for the purchase of the car and even though the loan is secured by the business property the personal loan interest portion is not deductible. Interest on loans is deductible under CRA-approved allowable motor vehicle expenses.

When you can deduct car loan interest from your taxes. Get Your Report Score. However LoanMart has competitive interest rates and long repayment terms so you can pay off your loan FAST which can be a much better benefit.

For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for single people or married people filing separately. Reporting the interest from these loans as a tax deduction is fairly straightforward. However if you are buying a car for commercial use you can show the interest paid.

The only exception to this rule is if your car is used for business purposes in which case you will qualify for a car loan tax deduction. If deducting business expenses is new for you make sure to consult with. Unfortunately auto loan interest no longer qualifies to be deducted from your taxes.

Interest on car loans may be deductible if you use the car to help you earn income. In addition interest paid on a loan used to purchase a car for personal use only is not deductible. Investment interest Qualified mortgage interest.

History of the 60L Power Stroke Diesel Engine. The taxpayer borrows 50000 secured by his home to be used in his consulting business. Experts agree that auto loan interest charges arent inherently deductible.

1 day agoThe Student Loan Interest Deduction allows you to deduct up to 2500 in student loan interest from your taxes. When you file your taxes with the Internal Revenue Service IRS there are many rules about what can be deducted and how. Similarly a home loan is tax deductible a year 2018.

On the condition that you have a business car or you use your personal vehicle for business purposes you may be eligible to deduct car loan interest parking fees and tolls and personal property tax. 8 hours agoThe American Rescue Plan made student loan forgiveness tax-free through 2025 meaning borrowers eligible for cancelation wont face a larger federal tax bill come April. The interest you pay on student loans and mortgage loans is tax-deductible.

If you paid 600 or more in interest on your student loans during the tax year you should receive a Student Loan Interest. This is why you need to list your vehicle as a business expense if you wish to deduct the interest youre paying on a car loan. Ad Check For The Latest Updates And Resources Throughout The Tax Season.

In contrast reporting the interest. Is interest on your car loan tax deductible. It can also be a vehicle you use for both personal and business purposes but you need to account for the usage.

You need to determine the percentage of time that the vehicle is driven for business needs against personal needs and apply. Interest on a home loan is tax deductible if your mortgage debt is within state limits and the money you borrowed was used to buy build or improve your home. Thus you are not eligible for any deductions on your Car Loan if you are buying for your personal use.

However it is possible for taxpayers who meet certain criteria. You can write off a part of your car loan interest if you bought a car for personal use but ALSO use it for business purposes. According to the report the new tax law suspends the home equity tax deduction from 2018 to 2026 unless the loan is used to.

Discover Helpful Information And Resources On Taxes From AARP. The faster you pay off your car title loan the less you will pay in interest. To do this you have to keep detailed records of these expenses and the miles you drive for business.

If you have a car loan for the vehicle you may also be able to deduct the interest when filing your federal tax returns. You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest may be tax deductible. Read on for details on how to deduct car loan interest on your tax return.

Tax benefits on Car Loans. Some of the documents to keep when claiming auto loan interest deduction on your tax return include. A log or record of all trips made in the vehicle for business.

Get a copy of your most recent credit report too. Pictures of Classic Ford Pickup Trucks. But you can deduct these costs from your income tax if its a business car.

However you can still get a bit of a tax break if you have a mortgage on a first or second home or if you are repaying student loans. When claiming deductions of any kind on your tax returns it is best to keep detailed records and supporting documents that can be used to verify all expenses in case of questions. Now you may be wondering is driving to work considered.

If youâre still unsure whether you qualify keep reading to see how car loan interest gets factored into your tax deduction. If you do use your vehicle for business a car. If youre an employee working for someone else you cant deduct auto loan interest expenses even if you use the car 100 for business purposes.

Since 2017 if you take the standard deduction you cannot deduct mortgage interest. A Brief History Of. Car is considered a luxury product in India and in fact attracts the highest Goods and Services Tax GST rate of 28 currently.

The amount you can deduct will depend on. If this vehicle is used for both business and personal needs claiming this tax deduction is slightly more complicated. The answer to is car loan interest tax deductible is normally no.

Is car loan interest tax-deductible. The taxpayer must allocate interest expense on the loan between rental interest and personal interest for the purchase of the car and even though the loan is secured by the business property the personal loan interest portion is not deductible.

Usa Real Estate Agents Tax Deduction Cheat Sheet Are You Claiming All Your Allowable Expenses Tax Deductions Real Estate Tips Estate Tax

35 Fi Used Car Donations Are Rapidly Increasing In Popularity Donate Car Car Car Car

Usa Real Estate Agents Tax Deduction Cheat Sheet Are You Claiming All Your Allowable Expenses Real Estate Checklist Real Estate Tips Real Estate School

Car Loan Tax Benefits And How To Claim It

Use Our Free Mortgage Calculator To Help You Estimate Your Monthly Mortgage Payments Account For Interest Rat Mortgage Calculator Mortgage Car Loan Calculator

Irs Tax Forms Infographic Tax Relief Center Irs Tax Forms Irs Taxes Tax Forms

Jamesreilly Co Uk Tax Refund Tax Return Income Tax

How Does Car Loan Interest Work Bmo

Tax Planning How To Plan Investing Budgeting Finances

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Is Car Loan Interest Tax Deductible In Canada

Car Loan Tax Benefits On Car Loan How To Claim Youtube

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

Lokpriya Finance In 2022 Dream Cars New Cars Finance

Income Tax Task Cards Activity Financial Literacy Filing Taxes Math For Kids

What Is The Average Car Loan Interest Rate In Canada Loans Canada